Five Supply Chain Trends Every Leader Should Watch in 2026

Insights from the 2025 CGT “Resilience in Motion” Research Study

Omnifold is the Title Sponsor of this research.

The supply chain environment entering 2026 is marked by continued uncertainty: shifting customer demand, supplier variability, evolving global policies. To understand how manufacturers are responding, Consumer Goods Technology (CGT) surveyed 60 senior decision-makers across the industry.

The results show where leaders are investing, where gaps remain, and which capabilities matter most. Here are the five most meaningful findings.

1. Demand volatility

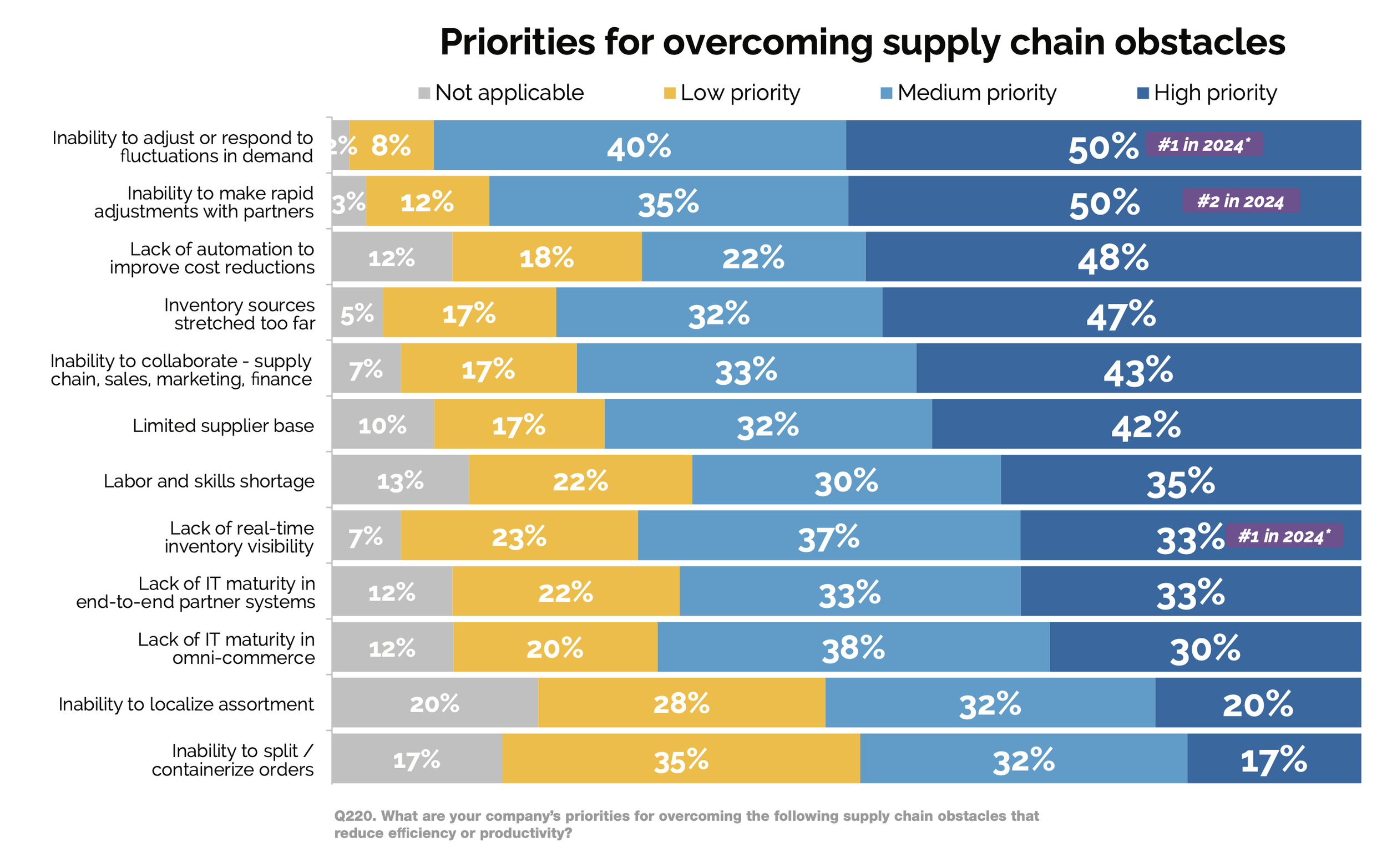

Demand volatility was ranked the #1 supply chain obstacle. Most companies still struggle to respond quickly when demand changes, which cascades into inventory imbalances and customer service failures.

The underlying problem: demand shifts faster than current solutions can absorb. Statistical methods, ML models, and spreadsheet formulas all require manual intervention when conditions change. By the time planners update their assumptions, the business conditions have changed again.

Key takeaway: the ability to quickly and accurately react to change (making plan adjustments) is critical.

2. Inventory challenges

Compared to last year’s report, inventory visibility is improving – it dropped in priority as companies invested in better transparency across their networks. But execs continue to rank forecast accuracy as a major challenge, because visibility doesn't solve accuracy. Even when you can see your inventory, forecast errors and suboptimal inventory controls still create excess stock or stockouts.

Key takeaway: Inaccurate demand forecasts, manual workflows, SKU proliferation, and supplier variability remain core drivers of excess inventory or stockouts.

3. AI and forecasting investment priorities

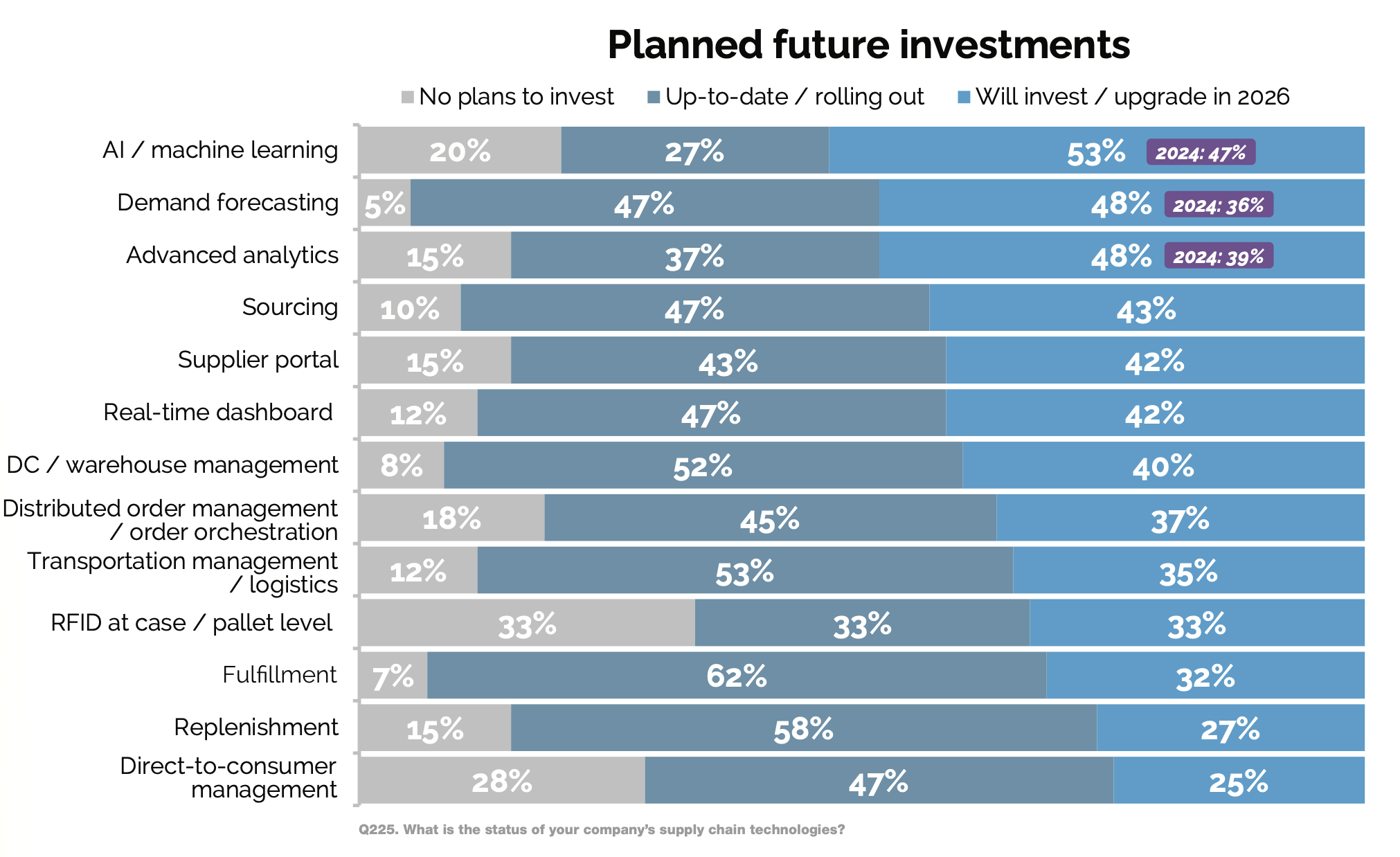

CGT shows a clear inflection point: AI/ML and demand forecasting are the two fastest-growing areas of planned investment. More than half of leaders expect to upgrade AI capabilities in 2026, and nearly as many expect to modernize their forecasting systems.

What's notable: companies are prioritizing demand forecasting improvements even when modern tooling may already be in place. As we’ve written previously, bolting general-purpose AI onto legacy platforms doesn't work. Leaders may be recognizing that chat interfaces and agentic tools weren't designed to solve quantitative prediction problems.

Key takeaway: now is the time to invest in AI strategies that have a quantifiable impact on the hard costs of running a supply chain.

4. Collaboration

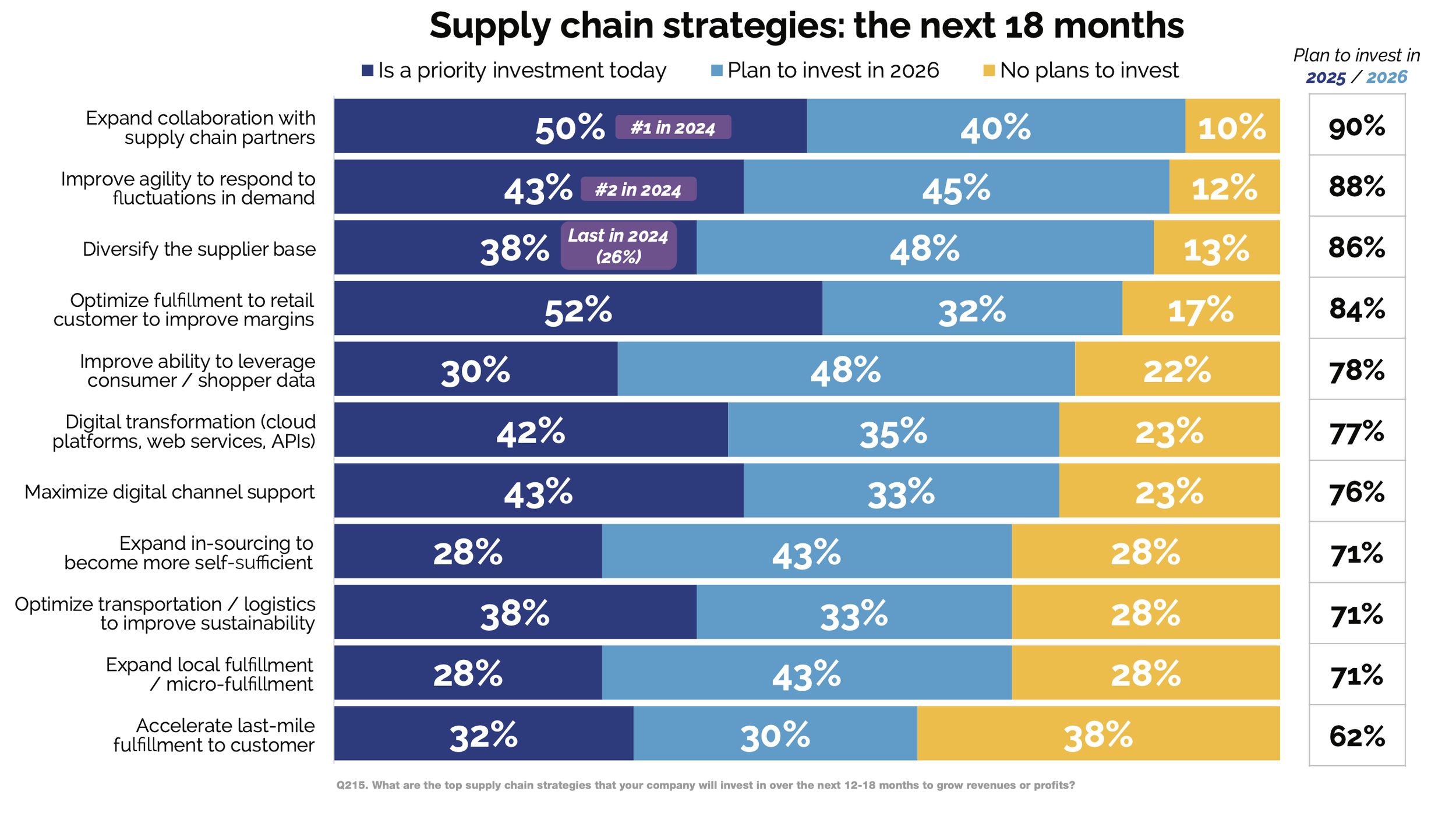

Collaboration remains the top strategic initiative for the next 18 months, even after meaningful improvements across internal teams, suppliers, and partners.

Organizations that invested in shared visibility, communication tools, and integrated data flows are seeing better agility and higher service-level performance. On the horizon is also the opportunity to not only improve human-to-human collaboration, but also human-to-AI collaboration.

Key takeaway: the more we can integrate data from all parts of the ecosystem, the better positioned we are to react and deal with change. Building AI systems that can benefit from this expanded ecosystem is paramount.

5. External pressures

Tariffs are cited in the report, but the broader finding is that external disruptions of all kinds – policy changes, cost volatility, supplier shifts, unexpected demand patterns – are forcing companies to rethink long-standing strategies.

Nearly all manufacturers surveyed made strategic adjustments over the past year: supplier diversification, revised pricing models, changes in sourcing locations and methods.

No system, even based on the most advanced AI, will predict every change. Planners need systems which can allow them to instantly adapt to changes as they happen, rather than spending hours on manual calculations to execute on every piece of new information.

Key takeaway: Resilience now requires systems and processes that can adjust quickly as conditions evolve.

The research reveals a stubborn issue for supply chain leaders. They have invested in visibility, collaboration and generative AI, but demand volatility remains the #1 obstacle. The business impact of inaccurate forecasts ripple across inventory, cost management, and customer experience.

The frontier of supply chain performance will come from companies who can quickly respond to the unknown. It’s probably no surprise to you that AI will play a prominent role in delivering the superhuman speed and context-awareness required in 2026.

Download the full research paper from CGT here:

https://consumergoods.com/2025-supply-chain-technology-study