The Cost of Bad Forecasts: Stories from the Field

We've written elsewhere about why common tools like spreadsheets fail at demand planning. The short version: they force you to collapse complexity into averages, freeze assumptions at the moment you enter them, and can't model the millions of potential scenarios in modern supply chains.

This piece focuses on what happens downstream when forecasts break down, with real stories from the supply chain teams we've worked with.

Overforecasting hurts

A high-growth brand was expanding into a new country, where their estimates were nearly 400% higher than actual demand. This resulted in parking more than $9M of inventory in that country: some SKUs took more than 9 months to burn down the inventory. And worse, the unexpected impacts of tariffs meant they could not repatriate the product for use elsewhere.

Underforecasting hurts

On the flip side, a consumer electronics company launched a premium variant of their flagship product and significantly underestimated demand. Shoppers saw an eight week lead time and many cancelled their orders – in the first couple months post-launch, the company estimates they lost around $800,000 from the forecast error.

Forecasting without granularity hurts

One CPG company had good forecast accuracy (95%+) at the company level, and at the regional level – but actual supply chain decisions happen at the SKU-per-distributor level. At this level of granularity their forecast error was around 40%, which led to them carrying $2.7M in excess finished goods.

Similarly, a multi-billion dollar manufacturing company was spending more than $10 million annually on expedited freight, and more than $5M on repositioning inventory. The amounts were roughly correct, but the timing was wrong, and the SKUs weren’t made at the right plant for the right customer.

Replanning hurts

The CPG company mentioned earlier faced another operational burden: constant replanning. Their spreadsheet treated distributor launches and SKU mix as static inputs, but the actual business changed constantly.

A new distributor's launch conditions would shift (different states, different timing, different initial orders). The static spreadsheet couldn't incorporate these changes without manual rework. By the time the planner updated the assumptions, new information had arrived.

Forecasting without confidence hurts

Confident forecasts unlock better economics. If you put your money where your mouth is, you can secure larger discounts from co-manufacturers during annual capacity negotiations, and you can commit to full production runs instead of partial ones.

Omnifold works with many fast-growing brands that have inherently volatile demand. Some of them have decent forecast accuracy, but when seven-figure purchasing decisions are on the line, we see teams miss out on economies of scale due to lack of confidence in their forecasts. The hesitation is rational, but expensive.

What Accurate Forecasts Enable

Omnifold builds supply chain forecasting AI specifically to tackle these challenges:

The company hedging with partial runs now commits to full runs, based on confidence in their volumes and SKU mix (and alignment with Finance)

The consumer electronics company can model new product configurations before launch and adjust procurement and production plans to prevent out of stocks or extended delivery times.

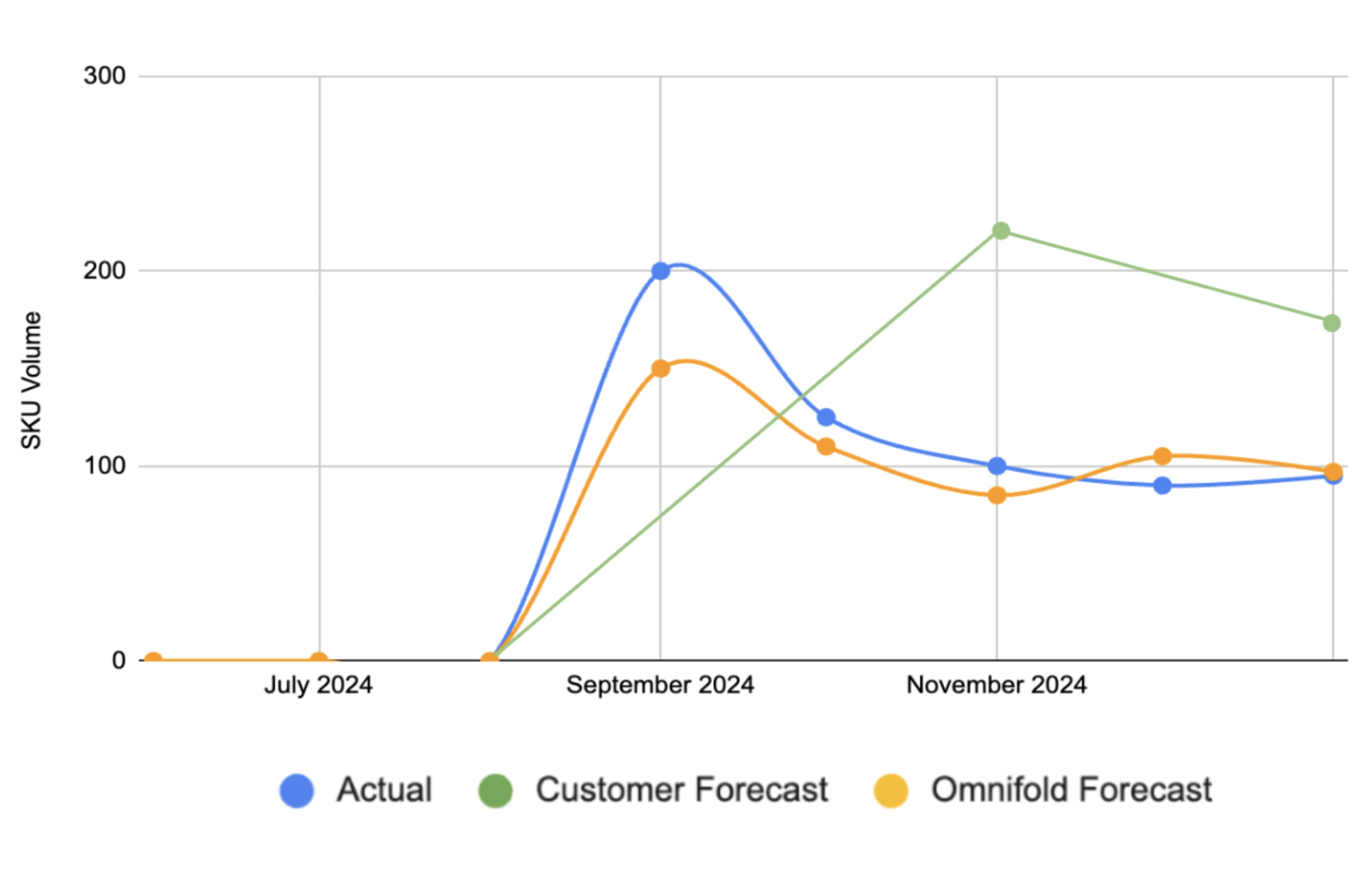

The CPG company now forecasts 6-9 months out within 5-10% of actuals. New distributor launches start at 70% accuracy in month one and reach 90%+ by month three

These improvements came from moving beyond spreadsheets and traditional planning systems to demand planning software, powered by purpose built AI that can actually model supply chain complexity. Unlike other systems which effectively bolt a chatbot onto legacy software, Omnifold optimizes across channels, SKUs, locations, and time horizons, with continuous learning even from minimal historical data.

The question isn't whether your current approach is creating costs. The question is whether those costs are large enough to do something about it.